Fraud Prevention Debit Card and App

When my aunt’s debit card was skimmed at a gas station and she struggled to get her money back, I decided to design a product that could prevent that from happening in the first place.

This is how BlankPay began.

MY STARTING POINTI started digging into how fraud happens at gas stations.

Why does fraud happen there so often? How do skimmers even work? Why does the card stay active after you pay? What if it didn’t? Can protection happen automatically instead of after damage is done?

I wanted to understand why fraud happens at gas stations and whether it could be prevented.

INTERVIEWSTo understand what people actually think about fraud, I went to a local gas station and spoke with five people of different ages and backgrounds while they were getting gas or walking back to their cars.

Some of the questions I asked were: “Have you or someone you know ever been a victim of card fraud?”, “How do you usually pay for gas and everyday purchases?”, “Do you use a credit card or debit card more often?”, and “If your debit card were skimmed, what would that mean for you financially?”

“How concerned are you about fraud?”

—The main question that shifted my thought process during my interviews

Some people answered right away. Some had to think. Some didn’t seem worried at all.

After the interviews, I stepped back and looked at everything together. Those patterns changed how I understood the problem.

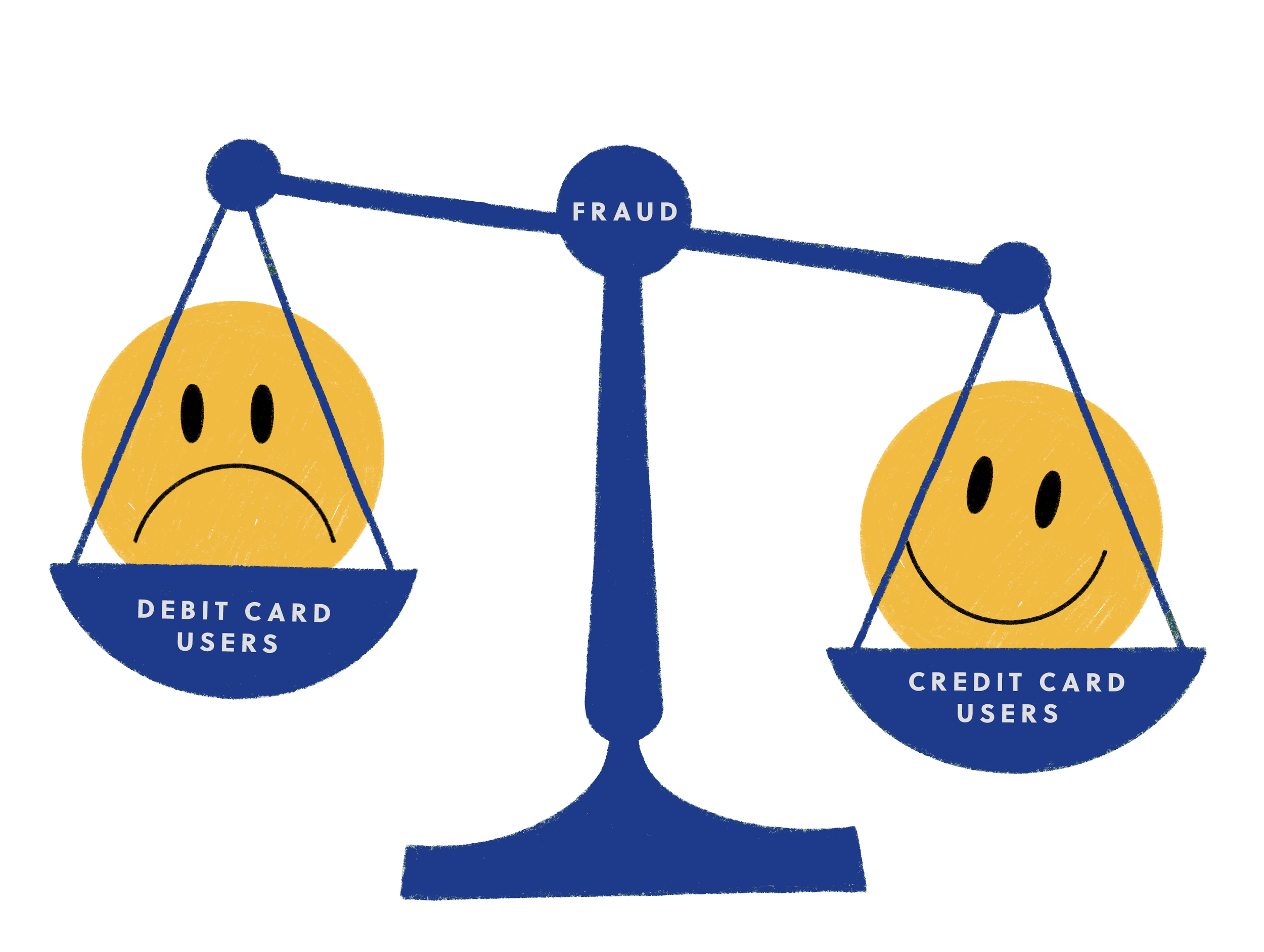

RETHINKING THE PROBLEMWhen I synthesized the interviews and looked at everyone’s answers side by side, one thing became clear. Not everyone fears fraud.

People who mostly use credit cards weren’t as worried. They knew they would be protected if something went wrong. Fraud felt like an inconvenience.

But people who relied on debit talked about it very differently. For them, fraud meant frozen accounts, waiting days for money to return, and stress over basic things like rent, gas, and groceries.

That’s when the problem shifted. This wasn’t really about gas stations anymore — it was about debit. And it wasn’t just about fraud happening. It was about what happens to people after fraud.

I realized I needed to design for debit users who don’t have the safety net of credit, and who need control and peace of mind, not just apologies after damage is done.

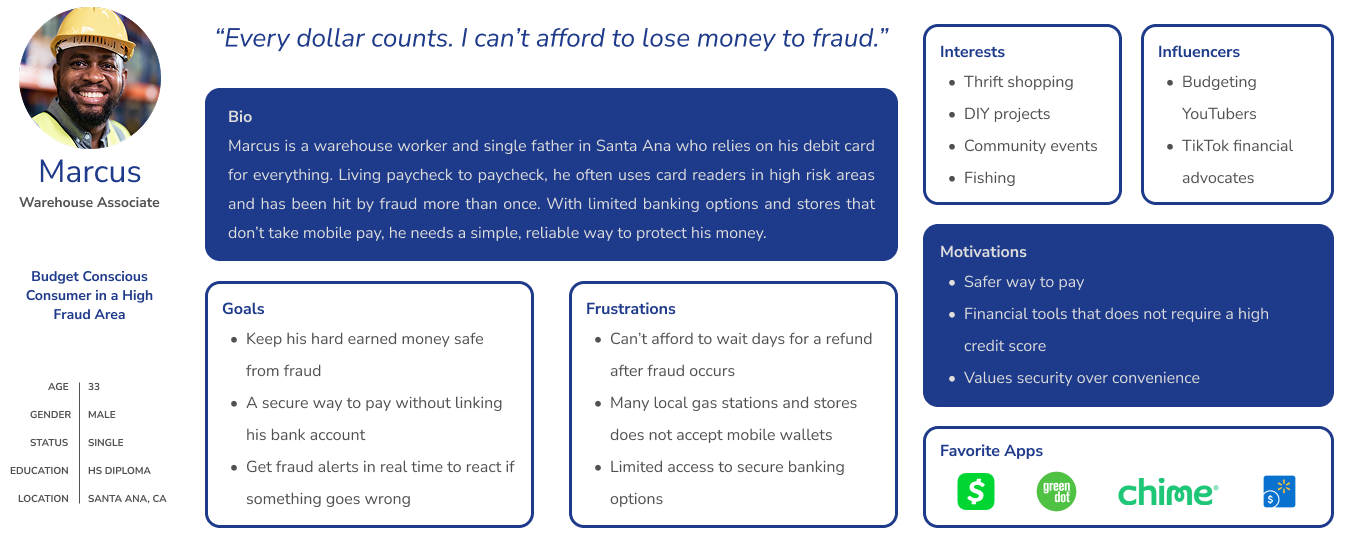

WHO I'M DESIGNING FORNow that I understood who this problem really affected, how they think, and what they need, I created a persona to keep that person in mind while designing.

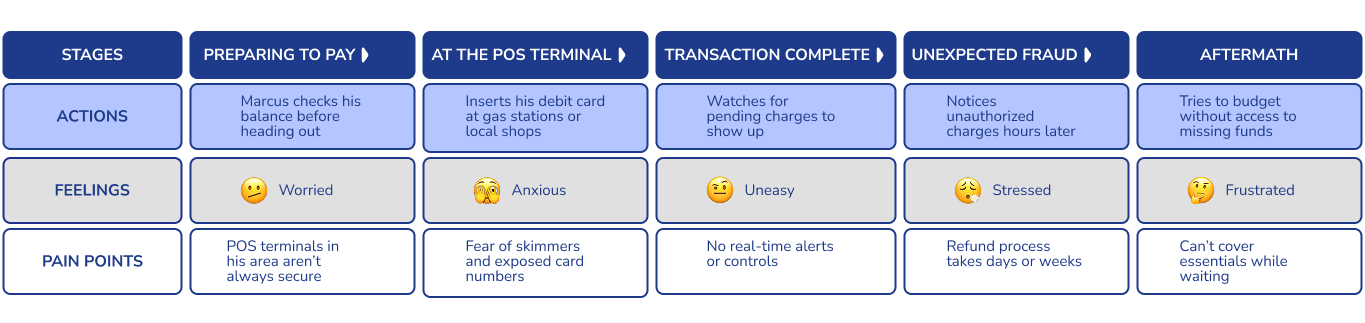

THEIR JOURNEYI created a journey that shows what everyday spending looks like for someone who relies on debit. Most of the time, it feels normal. They use their card for gas, food, coffee, and small purchases without thinking twice.

Nothing looks wrong, and they assume the transaction is over. But this is when risk quietly begins.

If fraud happens, they usually don’t find out right away. They notice it later when checking their balance or getting a notification. By then, the damage is already done.

Fixing it is slow. They call their bank, explain what happened, and wait days for their money to return. During that time, basic things like gas, groceries, and rent feel uncertain.

The hardest part isn’t just losing money. It’s losing control.

These are the moments I wanted to change.

WHERE IT BREAKS“I paid.”

“It’s done.”

—What the user thinks

Card stays active.

Risk begins.

—What actually happens

After a user pays, the system leaves them unprotected. The card stays active. Nothing signals danger. Nothing gives control. From the outside, everything looks finished.

But this is when risk quietly begins.

SKETCHESWith my problem mapped out, it was time to design. I started with rough sketches to explore how someone could control their money in real time. My solution was to design a system made up of two parts: an app and a debit card.

I sketched ideas for locking and unlocking the card, automatic locking after purchases, setting daily limits, viewing transactions, and how the app and the physical card would work together.

I showed these early sketches to a user. They liked the idea of setting a daily limit and locking their card, but one thing stood out: locking the card took too many steps. They wanted control, but they wanted it fast.

That told me protection couldn’t be hidden. I made that one of the focal points when moving into high-fidelity design.

HI-FI PROTOTYPES: GHOSTPAYI turned the sketches into a high-fidelity prototype called GhostPay — an early working name for what would later become BlankPay. I also created an early design for the debit card.

SPLASH SCREEN

LANDING SCREEN

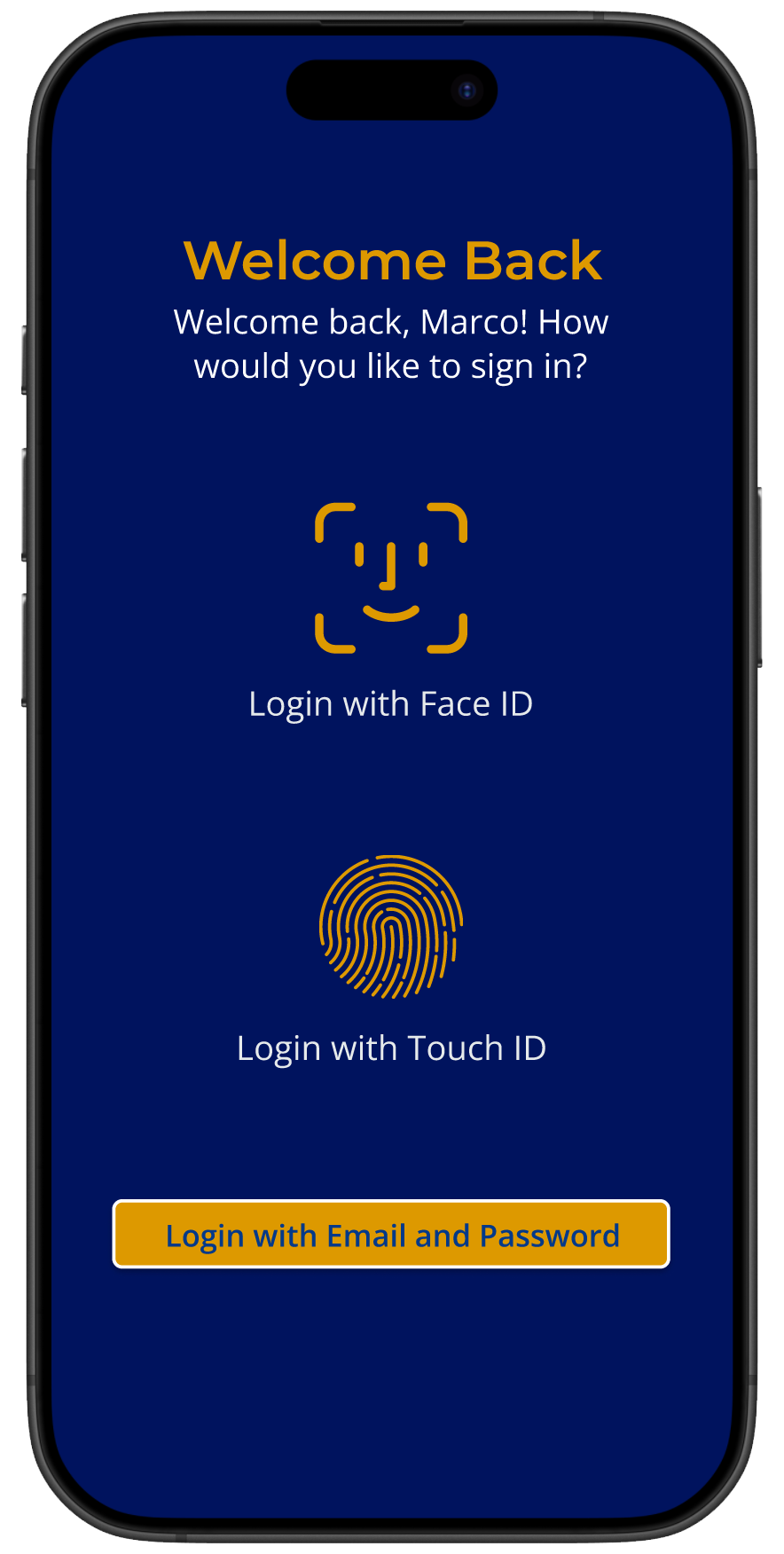

SIGN UP / SIGN IN

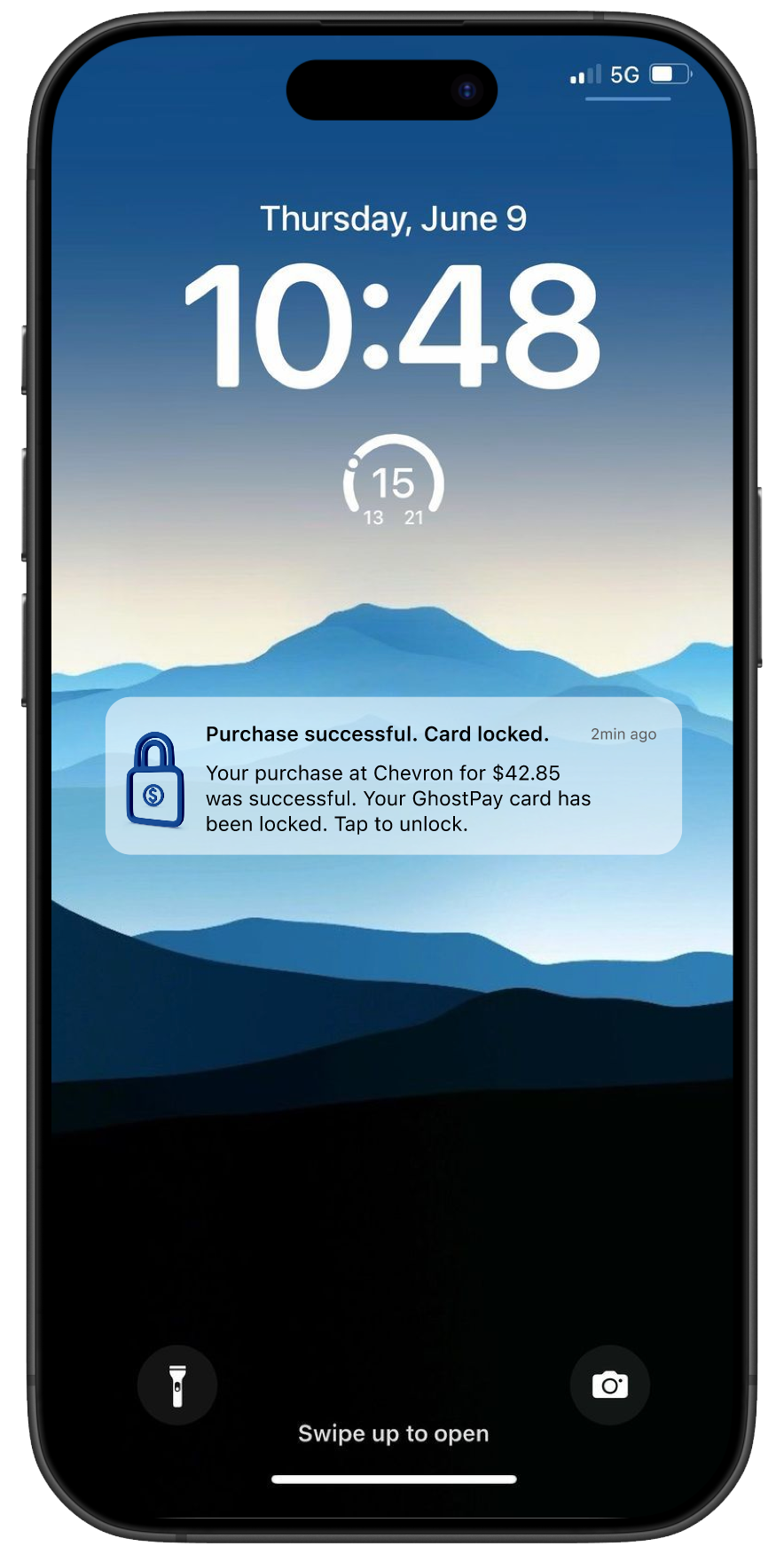

AUTO CARD LOCK NOTIFICATION

HOME SCREEN

ACTIVATE CARD

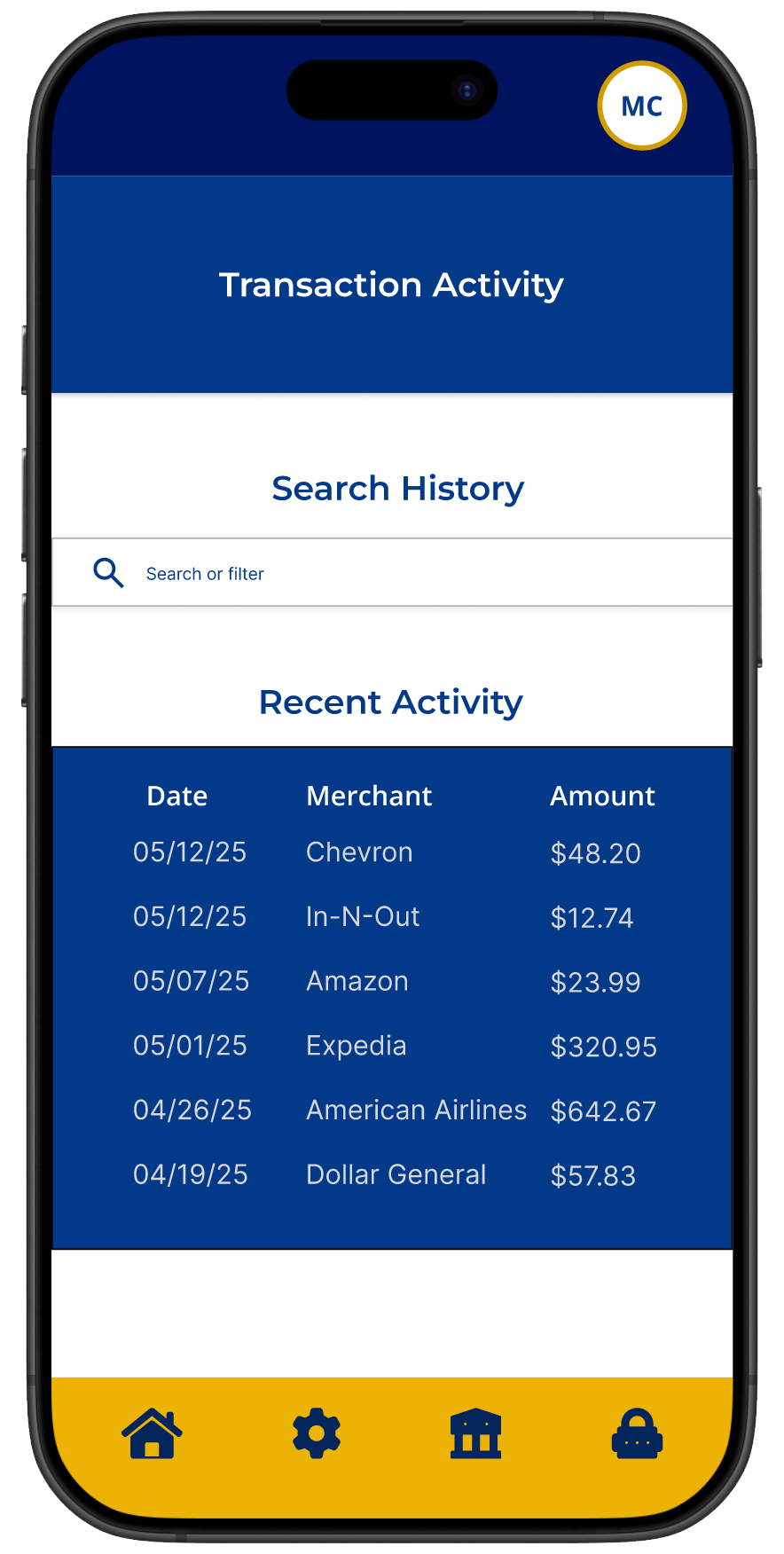

TRANSACTION HISTORY

RECENT ACTIVITY

Once the prototype was finished, I reached out to two peers from college who connected with the problem because they relied on debit and worried about fraud. I asked them to try the app.

The feedback was underwhelming. They said:

A lot of screens were too busy and had no breathing room.

It didn’t feel like a real financial product.

The colors were too bold.

After completing actions, they weren’t always sure it worked.

Locking the card still didn’t feel obvious.

They weren’t sure when the card was locked or if it had locked automatically after a purchase.

That told me the idea was there, but the experience wasn’t.

RETHINKING THE EXPERIENCEOld name and logo

I went back to the drawing board with clearer goals:

Make locking the card and automatic locking after purchases the most visible behavior.

Make every action feel clearly complete.

Make the design feel calm, safe, sleek, and trustworthy.

Make the design simple and breathable.

Make the card and app feel like one system.

I also came up with a new name — one that embodied the sleek, calm and trustworthy experience I envisioned: BlankPay.

New name and logo

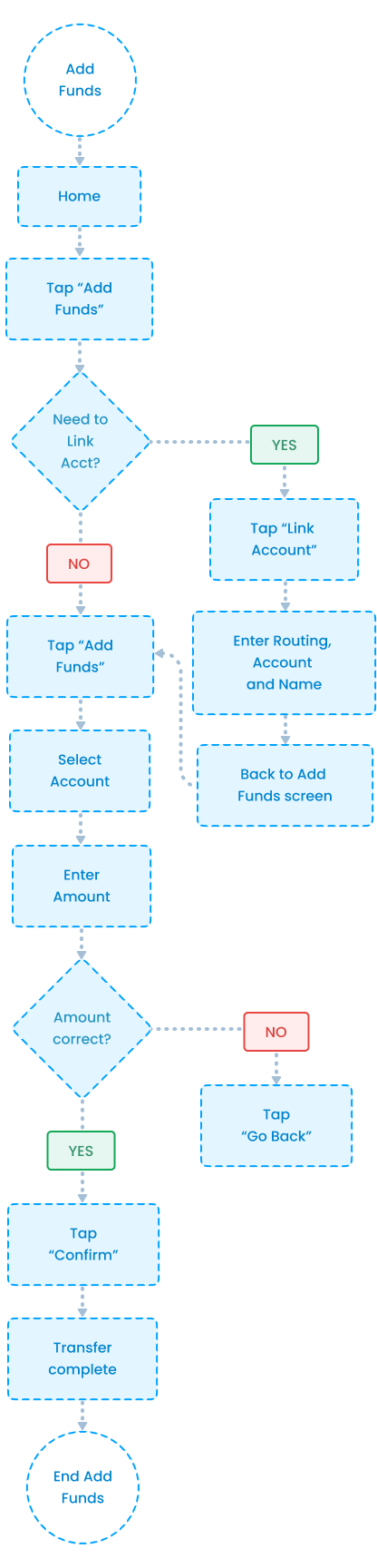

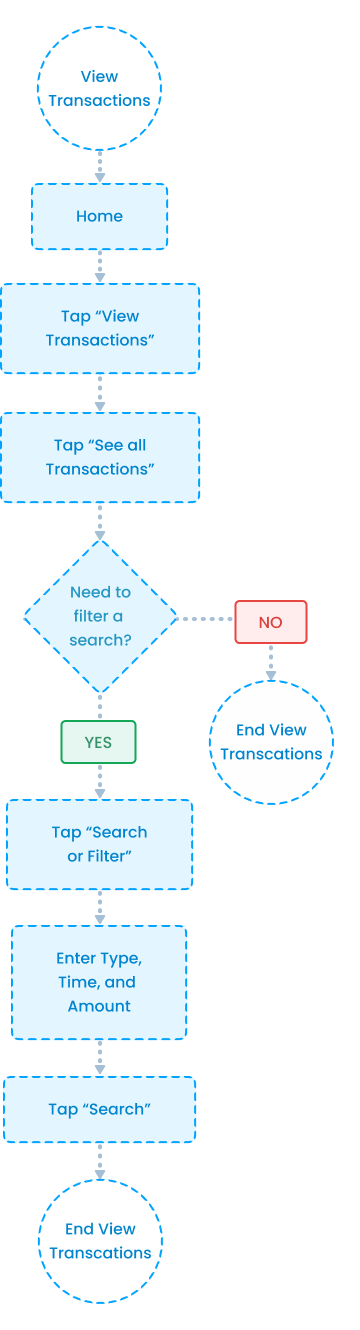

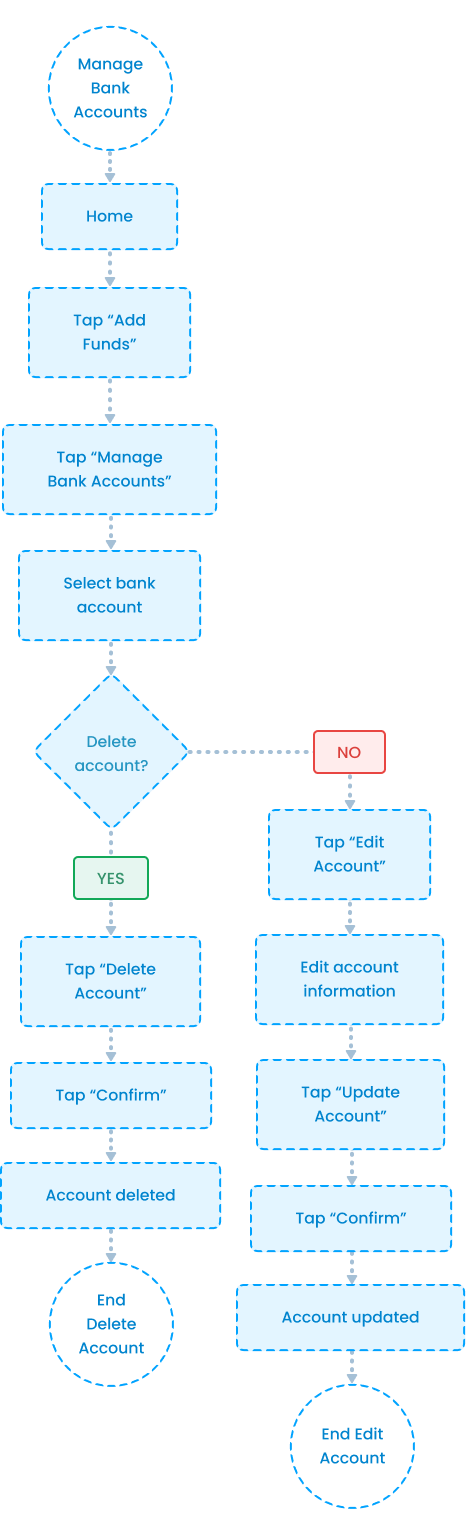

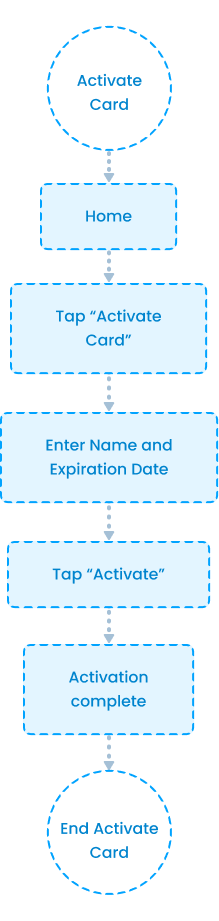

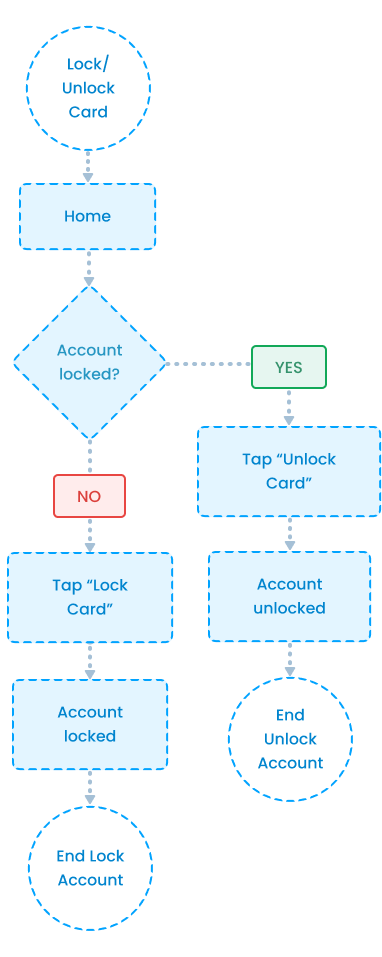

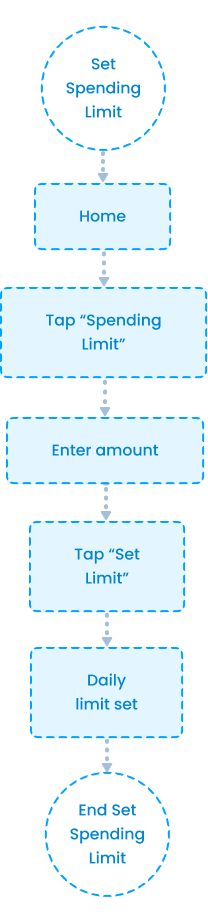

MAPPING THE NEW EXPERIENCEUser flows helped me identify key actions, decision points, and moments where users might hesitate or feel unsure. This allowed me to simplify the experience, prioritize safety related actions, and create a layout that feels predictable and controlled.

ADD FUNDS

VIEW TRANSACTIONS

MANAGE ACCOUNTS

ACTIVATE CARD

LOCK/UNLOCK CARD

SET SPENDING LIMIT

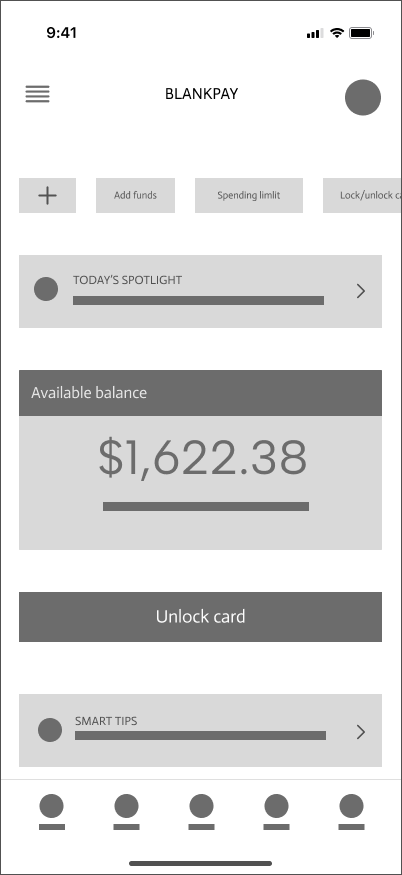

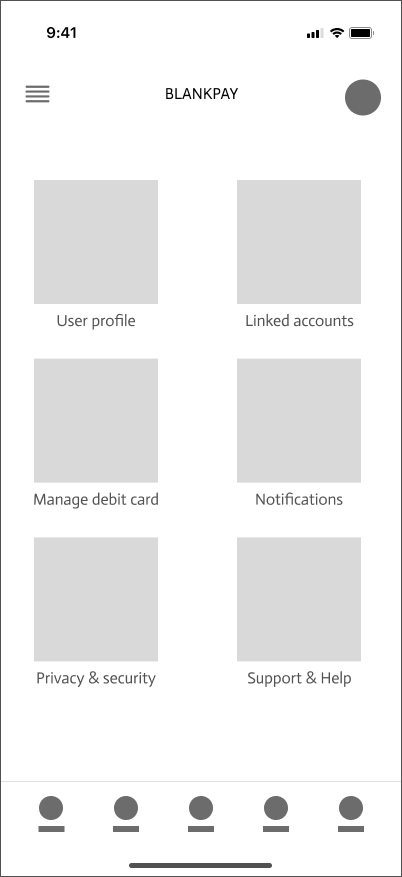

MID-FIDELITYMid-fidelity screens helped me focus on structure, clarity, and flow before visual styling.

I used this stage to test spacing, hierarchy, and how easily users could understand what to do next.

HOME DASHBOARD

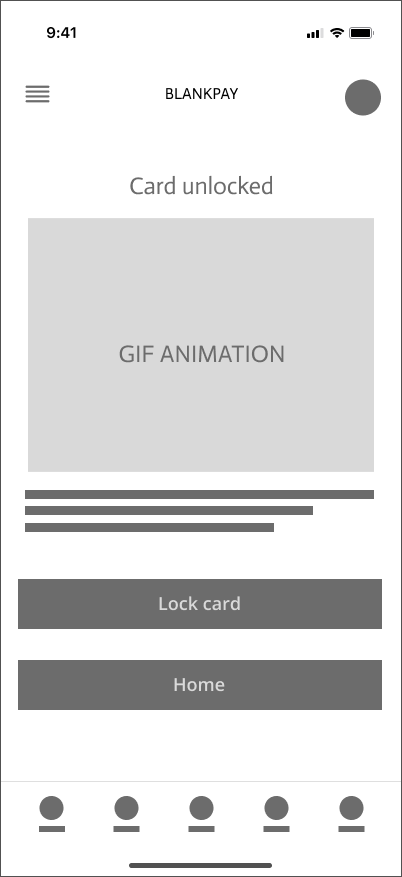

CARD LOCKED / UNLOCKED

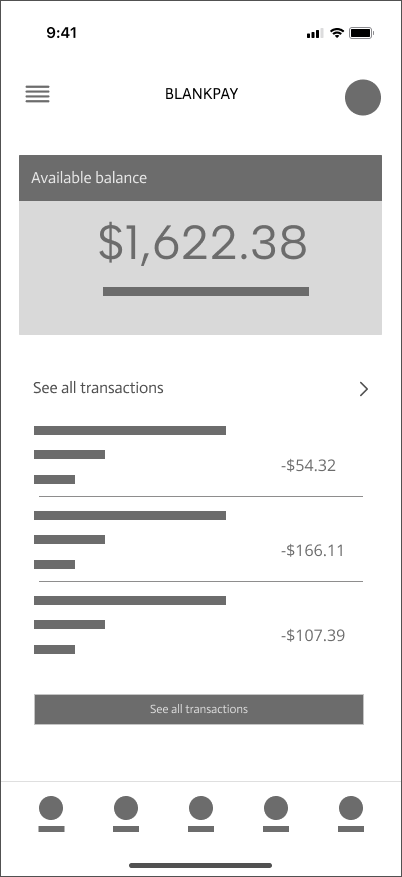

VIEW TRANSACTIONS

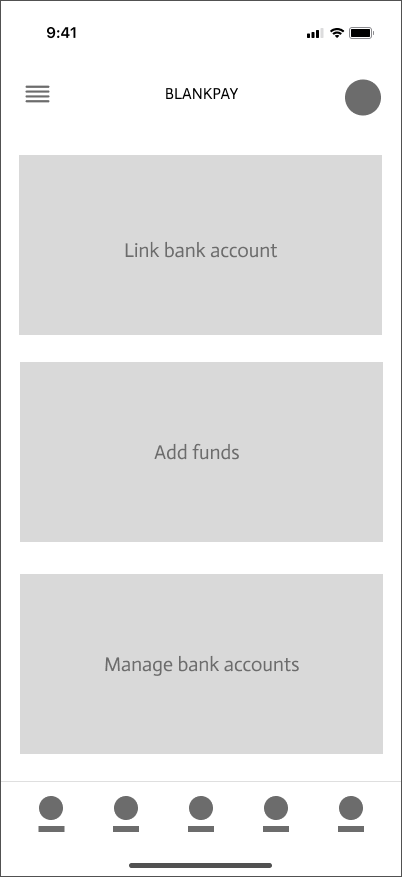

ADD FUNDS / LINK + MANAGE ACCOUNT

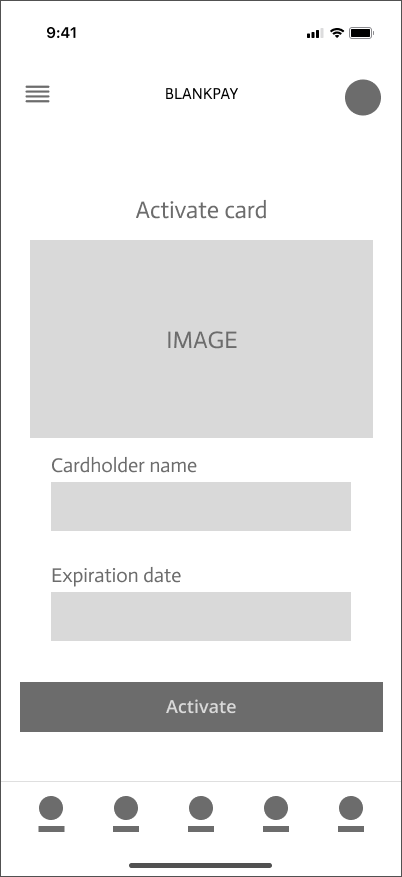

ACTIVATE CARD

SETTINGS

THE FINAL PRODUCTONBOARDING

A branded splash screen followed by three value focused screens that explain how BlankPay stays secure by default. Users can then create an account or sign in.

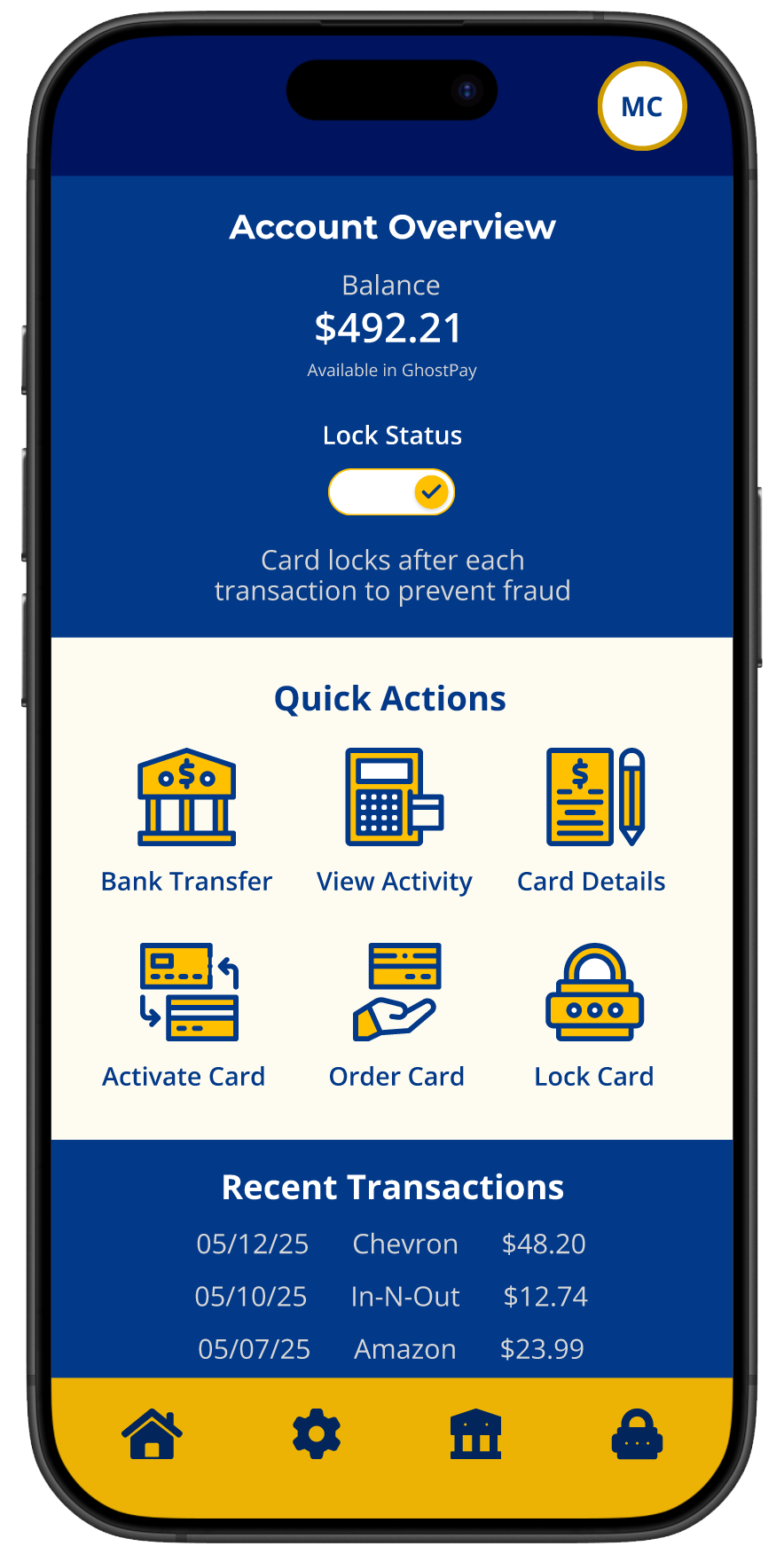

HOME SCREEN

A centralized view of balance, card controls, quick actions, and ongoing security activity designed for fast, confident use.

LOCK/UNLOCK CARD

A primary lock control paired with immediate visual feedback reinforces that the card state has changed.

ADD FUNDS

Users can select a saved bank account and confirm the amount before funds are added, with clear feedback confirming a successful transfer.

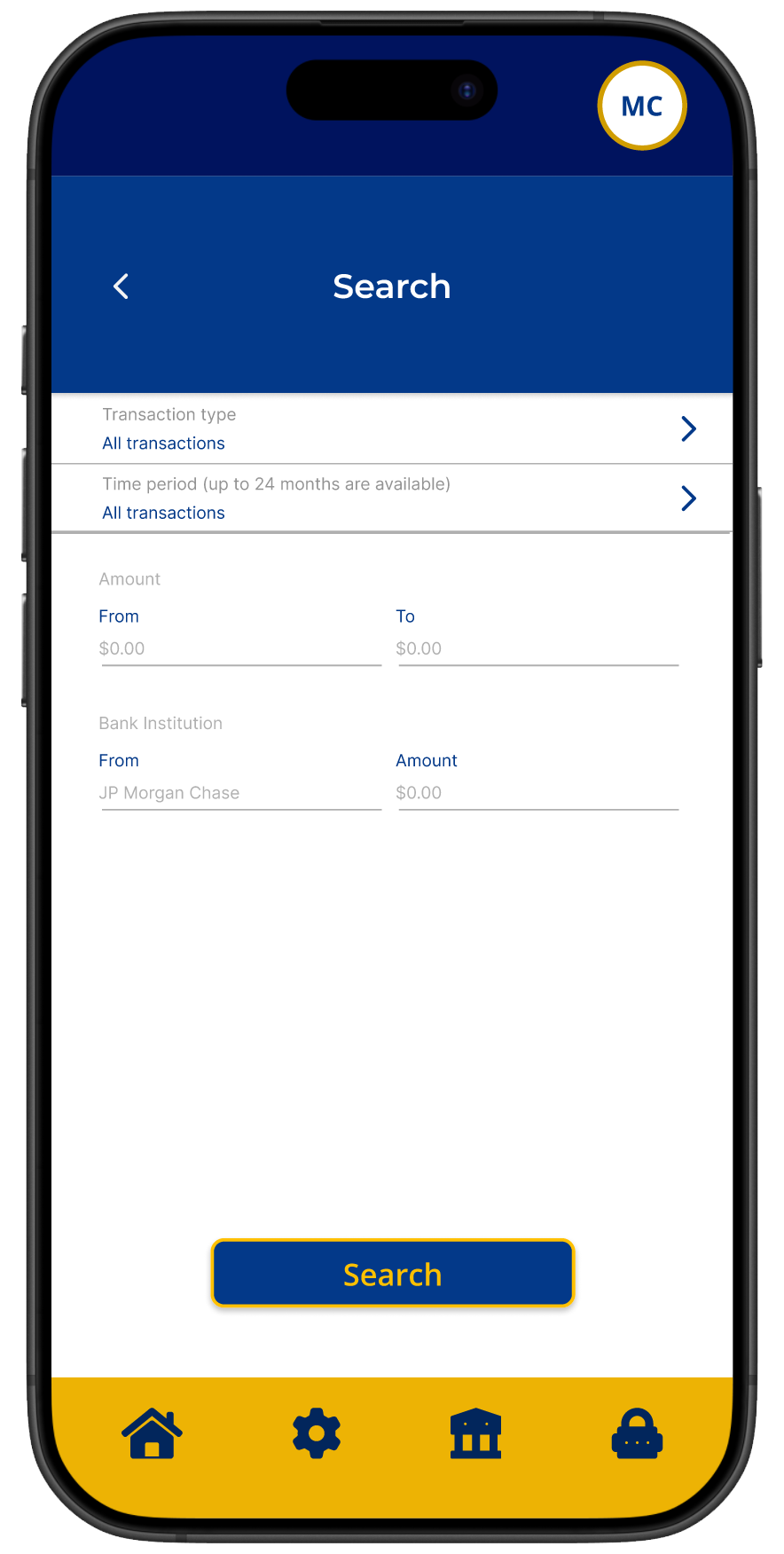

VIEW TRANSACTIONS

A clear transaction history allows users to review purchases and credits, with filters for type, time frame, and amount.

SPENDING LIMIT

Users can set a daily spending limit with a confirmation step and clear feedback once the limit is applied.

ACTIVATE CARD

Users activate their card by entering the cardholder name and expiration date, with clear confirmation once activation is complete.

CARD LOCKED NOTIFICATION

After a transaction is completed, users receive a confirmation that the purchase was successful and the card has automatically locked.

Together, these interactions make security feel clear, automatic, and trustworthy throughout the experience.

TESTING AGAINI went back to the same two peers and asked them to try BlankPay. I told them I had taken their feedback seriously.

Their reactions were completely different. They said locking the card felt fast and obvious. They always knew when something worked. They understood when the card locked automatically after a purchase. And the design felt safer and more trustworthy.